Think about strolling by way of Walmart, cart overflowing with goodies, and the checkout line looms. You are considering, “Would not or not it’s improbable to unfold out these funds?” Nicely, the query on everybody’s thoughts is, can I exploit Klarna in retailer at Walmart? We’re diving headfirst into this thrilling matter, unraveling the mysteries of Klarna’s presence on this planet of blue-vested retail giants. Overlook countless searches and complicated jargon; we’re right here to supply a transparent, concise, and interesting exploration of how one can doubtlessly store smarter at Walmart.

We’ll journey by way of the supply of Klarna, the step-by-step processes for in-store utilization, and the varied fee choices that Klarna gives. We can even peek at Walmart’s various fee strategies, plus we’ll be prepared to handle potential troubleshooting situations, and discover the benefits and drawbacks. This isn’t nearly a easy sure or no; it is about understanding how Klarna can match into your buying technique and empower you to make knowledgeable choices.

We’ll delve into the way forward for this partnership, safety measures, and tackle your considerations, so put together to be told and maybe, just a little bit extra financially savvy!

Klarna at Walmart

Let’s delve into the fascinating world of Klarna and its presence inside the expansive realm of Walmart. We’ll discover the present panorama, hint its historical past (if any), and uncover the place you would possibly have the ability to make the most of this widespread fee choice whereas looking the aisles of your native Walmart.

Klarna’s Availability at Walmart: Present Standing

As of my present information cutoff date, Klarna isnot* instantly accepted as a fee methodology for in-store purchases at Walmart. You will not have the ability to merely swipe your Klarna card or choose it as a fee choice on the checkout registers. This is a vital distinction to make for customers planning their purchases.

Historic Perspective: Klarna’s Journey with Walmart

Whereas Klarna may not be a direct fee methodology in Walmart shops, the story is not fully over. The connection between these two entities has advanced, and understanding this evolution is vital. It is essential to acknowledge that partnerships and fee choices can change, so it is at all times finest to confirm essentially the most up-to-date data instantly from Walmart or Klarna.

Geographical Distribution of Klarna at Walmart

Since direct in-store Klarna funds aren’t obtainable, there is not a geographical limitation within the conventional sense. The accessibility is not tied to particular states or areas inside the US, because the fee methodology is not supported on the level of sale.

In-Retailer Klarna Utilization

Let’s delve into the practicalities of using Klarna on your in-store buying sprees, particularly specializing in the Walmart expertise. Whereas the supply of Klarna in-store can fluctuate, understanding the method, ought to or not it’s provided, is essential for a seamless checkout. We are going to discover the steps concerned and the required preparations, equipping you with the information to doubtlessly leverage Klarna’s versatile fee choices at your native Walmart.

Process for In-Retailer Transactions

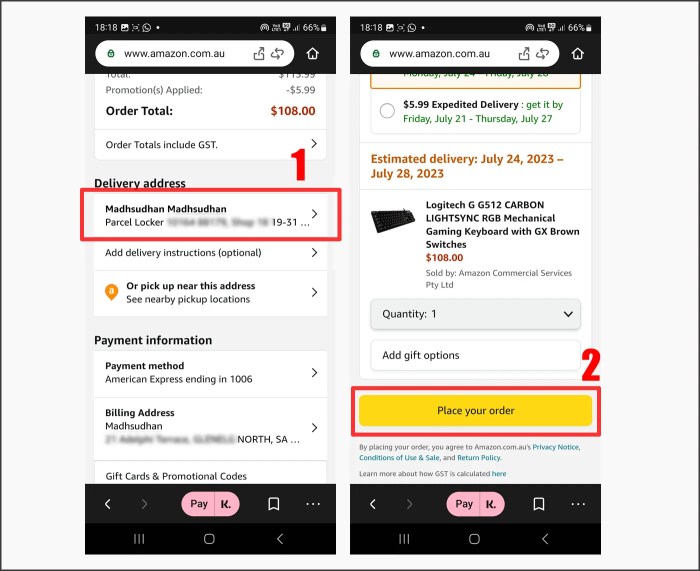

Assuming Klarna is supported on the Walmart location, here is a possible step-by-step course of for using Klarna on the checkout:

- Provoke the Transaction: Collect your required gadgets and proceed to a Walmart checkout lane. Inform the cashier that you just intend to pay with Klarna.

- Open the Klarna App: In your smartphone, launch the Klarna app. Guarantee you might be logged into your account.

- Choose In-Retailer Fee: Inside the Klarna app, search for an choice that claims one thing alongside the strains of “Pay in-store” or “In-store fee.” The precise wording would possibly fluctuate barely.

- Generate a Fee Code/Barcode: The app will probably generate a singular barcode or fee code particularly on your Walmart buy. That is your digital key to unlock Klarna’s fee choices.

- Current to the Cashier: Current the barcode or fee code displayed in your telephone to the cashier. They are going to scan it utilizing their point-of-sale system, simply as they’d scan a product’s barcode.

- Select Your Fee Choice: The cashier’s system ought to then combine with Klarna, permitting you to pick out your required fee plan. This would possibly embody choices like “Pay in 4” or different financing gives, relying on the present Klarna and Walmart settlement.

- Full the Fee: Comply with the on-screen prompts on the cashier’s system and within the Klarna app to finalize your fee. This may increasingly contain confirming your fee plan particulars and any required authorizations.

- Obtain Affirmation: It is best to obtain a affirmation inside the Klarna app and doubtlessly a receipt from Walmart, verifying your profitable buy.

Illustrative State of affairs

Think about Sarah is at Walmart, keen to buy a brand new tv. She’s determined to make use of Klarna to separate the price into manageable installments.Sarah has already arrange her Klarna account and downloaded the app. On the checkout, she informs the cashier that she intends to make use of Klarna. She then opens the Klarna app, selects the in-store fee choice, and a barcode seems on her telephone display.

The cashier scans the barcode, and the point-of-sale system integrates with Klarna. Sarah is offered with the choice to pay in 4 installments. She confirms her choice inside the app, and the transaction is full. She walks out of Walmart along with her new TV, assured in her budgeting selections.

Necessities and Stipulations

To efficiently use Klarna in-store, sure conditions should be met. These are important parts for a clean transaction.

- Klarna Account: It’s essential to have an lively Klarna account. This entails registering by way of the Klarna app or web site and offering the required private and monetary data.

- Klarna App: The Klarna cell app is important. It is the gateway to producing fee codes and managing your Klarna transactions. Be certain that it is downloaded and up to date in your smartphone.

- Accredited Fee Methodology: Inside your Klarna account, you have to have a linked and accredited fee methodology, similar to a debit card, bank card, or checking account.

- Walmart’s Help: This can be a essential issue. Klarna’s in-store availability at Walmart shouldn’t be universally assured. It will depend on the settlement between Klarna and the particular Walmart location. Examine for signage on the retailer or inquire with customer support.

- Ample Credit score/Out there Funds: Your Klarna account will need to have ample credit score or obtainable funds, relying on the chosen fee plan, to cowl the acquisition quantity.

- Smartphone with Web Entry: You will want a smartphone with a dependable web connection to entry the Klarna app and generate fee codes.

Klarna Fee Choices at Walmart

Navigating the checkout course of at Walmart will be made extra versatile with Klarna. This information delves into the varied fee plans provided, spending limits, and comparisons with different financing choices, serving to you make knowledgeable choices on your purchases.

Klarna Fee Plans for Walmart Purchases

Klarna presents a variety of fee plans designed to suit totally different budgets and buying wants. Understanding these choices is vital to leveraging Klarna’s flexibility successfully.Klarna gives a number of fee choices, sometimes together with:

- Pay in 4: This can be a widespread choice the place your buy is break up into 4 interest-free funds. The primary fee is due on the time of buy, and the remaining three are scheduled each two weeks. This can be a nice alternative for managing rapid bills with out incurring curiosity expenses.

- Month-to-month Financing: For bigger purchases, Klarna supplies month-to-month financing choices. These plans usually contain curiosity, and the compensation phrases can fluctuate, providing flexibility in the way you unfold out the price over time. The particular phrases depend upon the acquisition quantity and your creditworthiness.

- Pay Now: An ordinary choice to pay on your buy in full on the time of buy. That is the only choice and avoids any curiosity or installment plans.

Credit score Limits and Spending Thresholds with Klarna at Walmart

Klarna’s credit score limits and spending thresholds will not be fastened and might fluctuate based mostly on a number of elements. Realizing these limitations is vital for planning your purchases.Klarna assesses every buyer’s eligibility and spending restrict on a case-by-case foundation. These limits are influenced by:

- Credit score Rating: Your credit score rating is a major issue. The next credit score rating sometimes leads to a better spending restrict.

- Buy Historical past with Klarna: Earlier fee habits with Klarna, together with well timed funds and accountable spending, can improve your credit score restrict over time.

- Walmart Buy Particulars: The quantity of your supposed buy at Walmart performs a job. Klarna will assess your means to repay based mostly on the acquisition worth.

- Earnings and Monetary Stability: Whereas not at all times a direct requirement, Klarna might think about your earnings and general monetary stability when figuring out your spending restrict.

You will need to keep in mind that Klarna might deny you the usage of its companies or provide a decrease credit score restrict if it assesses a high-risk profile.

Evaluating Klarna’s Fee Choices with Different Financing Alternate options at Walmart

When contemplating financing choices at Walmart, it is smart to match Klarna with different obtainable selections. This comparability will help in figuring out the very best match on your monetary state of affairs.Right here’s a comparability desk outlining Klarna’s fee choices alongside different financing options obtainable at Walmart:

| Choice | Curiosity Price | Compensation Phrases | Eligibility Necessities |

|---|---|---|---|

| Klarna – Pay in 4 | 0% | 4 funds over 6 weeks | Varies based mostly on credit score rating and buy quantity |

| Klarna – Month-to-month Financing | Varies (sometimes 0% – 24.99% APR) | 6-36 months, relying on buy quantity and creditworthiness | Credit score examine required; varies based mostly on credit score rating and earnings |

| Walmart Credit score Card | 17.99%

|

Minimal month-to-month funds required; steadiness carried ahead | Credit score examine required; good to wonderful credit score advisable |

| Affirm (if obtainable) | 0%

|

3-36 months, relying on buy quantity and creditworthiness | Credit score examine required; varies based mostly on credit score rating |

The most suitable choice will depend on your particular person circumstances. In case you prioritize interest-free funds and must unfold the price over a brief interval, Klarna’s Pay in 4 is an efficient alternative. For bigger purchases, the month-to-month financing choices might present extra flexibility, however you will need to rigorously think about the rates of interest and compensation phrases.

The Walmart bank card generally is a viable choice in case you steadily store at Walmart and need to earn rewards. Affirm supplies one other various with various rates of interest and compensation phrases.

Walmart’s Fee Strategies: Can I Use Klarna In Retailer At Walmart

Navigating the checkout course of at Walmart entails quite a lot of fee choices. Understanding these options alongside Klarna empowers customers to make knowledgeable choices that align with their monetary preferences and desires. From conventional strategies to digital options, Walmart strives to supply flexibility and comfort on the level of sale.

Accepted Fee Strategies at Walmart

Walmart accepts a complete vary of fee strategies, catering to numerous buyer preferences. This flexibility ensures a seamless buying expertise for everybody.

- Money: Probably the most fundamental type of fee, accepted in any respect Walmart places. No charges are related to money funds.

- Credit score Playing cards: Main bank cards, together with Visa, Mastercard, Uncover, and American Specific, are broadly accepted. Walmart doesn’t cost charges for bank card transactions.

- Debit Playing cards: Debit playing cards linked to main networks are additionally accepted. Much like bank cards, there are sometimes no charges utilized by Walmart.

- Walmart Reward Playing cards: Walmart-issued present playing cards can be utilized for purchases. There are not any related charges.

- EBT (Digital Profit Switch): Walmart accepts EBT playing cards for eligible meals purchases, adhering to authorities laws. There are not any extra charges for EBT transactions.

- Checks: Private checks are accepted, however could also be topic to verification. Examine acceptance insurance policies might fluctuate by location, and there could also be charges for returned checks.

- Cell Fee Methods: Walmart accepts cell fee strategies like Walmart Pay (built-in inside the Walmart app), Apple Pay, Google Pay, and Samsung Pay. These strategies usually present a contactless fee choice. Walmart doesn’t cost charges for utilizing cell fee programs.

- Affirm: One other buy-now-pay-later choice that may be obtainable at sure places or on-line. The phrases and circumstances, together with rates of interest and costs, fluctuate relying on the particular settlement.

Evaluating Klarna with Different Fee Strategies

Selecting the best fee methodology at Walmart will depend on particular person circumstances. Think about the benefits and drawbacks of Klarna in comparison with different choices.

Klarna Advantages:

- Flexibility: Klarna gives fee plans, permitting clients to separate purchases into installments.

- Budgeting: Installment plans will help handle money move and unfold out the price of purchases.

- Instantaneous Approval: Klarna usually supplies fast approval choices, facilitating rapid purchases.

Klarna Drawbacks:

- Curiosity and Charges: Klarna might cost curiosity or charges relying on the fee plan chosen.

- Credit score Impression: Utilizing Klarna can doubtlessly influence credit score scores, particularly if funds are missed.

- Overspending: The convenience of installments can generally result in overspending.

Different Fee Methodology Advantages:

- No Curiosity: Money, debit playing cards, and bank cards (if paid in full and on time) don’t accrue curiosity.

- Established Methods: Conventional fee strategies are broadly accepted and acquainted to most customers.

- Simplicity: Utilizing money or a debit card is an easy transaction with no installment plans to handle.

Different Fee Methodology Drawbacks:

- Lack of Flexibility: Purchases should be paid in full on the time of buy (with money, debit, and bank cards).

- Potential for Debt: Utilizing bank cards can result in debt if not managed responsibly.

- Restricted Choices: Some fee strategies may not be obtainable in all conditions (e.g., checks).

For instance, think about a client wants a brand new fridge, which prices $800. In the event that they pay with a bank card, they will need to have the complete quantity obtainable or carry a steadiness that accrues curiosity. With Klarna, they may break the fee into installments, doubtlessly making the acquisition extra manageable, however at the price of potential curiosity or charges. Utilizing money or a debit card avoids curiosity however requires having the complete quantity instantly.

This comparability highlights the trade-offs concerned in every fee alternative.

Troubleshooting Klarna at Walmart

Utilizing Klarna at Walmart gives a handy strategy to handle your purchases, however generally, issues do not go as deliberate. Understanding find out how to troubleshoot frequent points can prevent time and frustration, guaranteeing a clean buying expertise. This part will information you thru resolving potential issues, accessing buyer help, and supply a useful troubleshooting information.

Declined Funds and Frequent Error Messages, Can i exploit klarna in retailer at walmart

Experiencing a declined Klarna fee at Walmart will be irritating. Understanding the explanations behind these declines is step one towards an answer. Typically, these points stem from numerous elements, and addressing them promptly is essential for finishing your buy.

- Inadequate Funds: The most typical cause for a declined fee is an absence of funds within the linked checking account or card. At all times make sure you find the money for obtainable to cowl the acquisition quantity, together with any relevant charges or taxes.

- Exceeding Spending Restrict: Klarna might have set spending limits based mostly in your creditworthiness and fee historical past. In case your buy exceeds this restrict, the transaction shall be declined. You would possibly want to regulate your buy quantity or think about using a special fee methodology.

- Incorrect Info: Double-check that every one the knowledge entered through the checkout course of, similar to your card particulars or billing tackle, is correct. Even a small error can result in a declined transaction.

- Safety Issues: Klarna and Walmart make use of safety measures to guard towards fraud. If a transaction is flagged as doubtlessly dangerous, it might be declined. Contacting Klarna’s customer support will help resolve such points.

- Technical Glitches: Generally, technical points on Klarna’s or Walmart’s finish may cause fee failures. Strive once more later, or contact buyer help for help.

Technical Glitches and Options

Technical difficulties can disrupt the Klarna fee course of. This is find out how to tackle them successfully:

- App or Web site Points: In case you encounter issues with the Klarna app or web site, attempt the next:

- Restart the App/Browser: Shut and reopen the Klarna app or refresh the Walmart web site.

- Clear Cache and Cookies: Clearing your browser’s cache and cookies can resolve non permanent points.

- Replace the App: Guarantee you’ve got the newest model of the Klarna app put in.

- Fee Processing Delays: Often, fee processing will be delayed. Enable a while for the transaction to finish. If it would not undergo, contact buyer help.

- Error Messages: Take note of any error messages displayed through the checkout course of. These messages usually present clues about the issue and find out how to repair it.

Buyer Help Choices for Klarna Customers at Walmart

Once you encounter issues with Klarna at Walmart, accessing the fitting help channels is essential. Klarna gives a number of methods to get help:

- Klarna App: The Klarna app is a central hub for managing your purchases, contacting buyer help, and accessing FAQs.

- Klarna Web site: The Klarna web site supplies complete data, together with FAQs, troubleshooting guides, and phone choices.

- Buyer Service Chat: Klarna gives a dwell chat characteristic inside the app and on the web site, permitting you to attach with a customer support consultant in real-time.

- E-mail Help: It’s also possible to contact Klarna by way of electronic mail for help. That is helpful for detailed inquiries or in case you desire written communication.

- Walmart Buyer Service: Whereas Walmart can not instantly resolve Klarna-specific points, they will help with in-store purchases and common inquiries associated to your buying expertise.

Troubleshooting Information: FAQs

This steadily requested questions part supplies fast options to frequent issues.

- My Klarna fee was declined. What ought to I do?

First, examine your obtainable funds and spending limits. Confirm that every one your data is correct. Contact Klarna buyer help if the issue persists.

- I am having bother logging into my Klarna account.

Ensure you are utilizing the proper login credentials. In case you’ve forgotten your password, use the “Forgot password” choice to reset it. If you’re nonetheless unable to log in, contact Klarna’s buyer help.

- How do I modify my fee methodology for a Klarna buy?

You may often change your fee methodology by way of the Klarna app or web site earlier than your fee is processed. Search for the “Handle Funds” or “Fee Choices” part.

- I acquired an error message throughout checkout. What does it imply?

Error messages present precious clues about the issue. Assessment the message rigorously. Frequent errors embody incorrect data, inadequate funds, or technical points. Check with the troubleshooting steps Artikeld earlier or contact Klarna help for additional help.

- The place can I discover my Klarna buy historical past?

You may view your buy historical past within the Klarna app or on the Klarna web site. This can present you all of your previous and present Klarna purchases.

Advantages and Drawbacks

Navigating the monetary panorama of retail can really feel like a tightrope stroll. Selecting the best fee methodology is essential, and Klarna, with its buy-now-pay-later (BNPL) mannequin, presents each engaging benefits and potential pitfalls when used at Walmart. Understanding these features is vital to creating knowledgeable monetary choices.

Benefits of Utilizing Klarna at Walmart

Klarna at Walmart gives a couple of compelling advantages that may improve the buying expertise, significantly for these seeking to handle their budgets or unfold out funds.

- Budgeting Flexibility: Klarna permits customers to interrupt down bigger purchases into smaller, extra manageable installments. This may be significantly useful for important gadgets or bigger purchases that may in any other case pressure a price range. Consider it as a strategy to soften the monetary blow of a big-ticket merchandise.

- Curiosity-Free Choices: Relying on the acquisition and the particular Klarna plan chosen, some choices provide interest-free funds. This can be a important benefit, because it permits shoppers to amass items with out incurring additional prices, supplied they meet the fee deadlines. This generally is a sensible transfer, particularly throughout instances of excessive inflation or when rates of interest are usually excessive.

- Comfort: The combination of Klarna into the Walmart fee system supplies a streamlined checkout course of. As soon as accredited, the fee course of turns into fast and straightforward. This comfort is a particular plus for busy customers.

- Potential for Constructing Credit score: Whereas not at all times the case, accountable use of Klarna can generally contribute to constructing a constructive credit score historical past, relying on the particular phrases and reporting practices of the Klarna plan. Making on-time funds constantly can positively influence your credit score rating.

Potential Disadvantages of Utilizing Klarna at Walmart

Whereas Klarna gives a number of perks, it is important to concentrate on the potential downsides to keep away from monetary pressure.

- Threat of Overspending: The convenience of splitting funds can generally result in overspending. The temptation to buy gadgets that aren’t instantly mandatory might come up, resulting in a build-up of debt.

- Late Fee Charges: Lacking a Klarna fee can set off late charges. These charges can rapidly add up, growing the general value of the acquisition.

- Impression on Credit score Rating (Destructive): Failing to make well timed funds can negatively influence your credit score rating. This could make it harder to acquire loans or credit score sooner or later.

- Restricted Availability of Klarna at Walmart: Klarna shouldn’t be universally obtainable in any respect Walmart places or for every type of purchases. This generally is a limitation for customers hoping to make use of this fee methodology. As an illustration, Klarna may not be obtainable for sure in-store purchases or on-line orders fulfilled by third-party sellers on Walmart’s platform.

Particular Promotions and Reductions with Klarna at Walmart

Promotions and reductions can generally sweeten the deal when utilizing Klarna at Walmart. These can vary from particular gives tied to Klarna’s fee plans to occasional collaborations between Klarna and Walmart.

Listed below are some issues to maintain a watch out for:

- Seasonal Gross sales and Promotions: Maintain a watch out for seasonal gross sales or promotional durations the place Klarna may be providing particular financing choices or reductions along side Walmart. These gives are often time-sensitive, so it is best to behave quick.

- Cashback Rewards: Some Klarna promotions would possibly provide cashback rewards on particular purchases made at Walmart. These rewards can present a bit of additional worth.

- Curiosity-Free Intervals: Sure Klarna plans would possibly provide interest-free durations for purchases at Walmart. This generally is a important profit, permitting you to repay your buy with out incurring any extra curiosity expenses.

- Partnership Offers: Every so often, Klarna and Walmart would possibly collaborate on unique offers or promotions. These may be marketed by way of Klarna’s app, Walmart’s web site, or in-store signage.

Way forward for Klarna at Walmart

The collaboration between Klarna and Walmart represents a big shift in how shoppers entry and handle their funds on the level of sale. Because the retail panorama continues to evolve, the way forward for this partnership holds thrilling potentialities, pushed by technological developments and altering client preferences. The combination’s trajectory is more likely to be dynamic, with potential modifications geared toward enhancing the consumer expertise and increasing Klarna’s attain inside Walmart’s ecosystem.

Potential Future Developments

Klarna’s presence at Walmart is poised for important evolution. This might contain a number of key areas of growth, every designed to refine the consumer expertise and increase the scope of Klarna’s companies.

- Enhanced Integration with Walmart’s Ecosystem: Think about a seamless connection between the Walmart app and Klarna. Prospects might browse, choose Klarna as a fee choice, and handle their installments instantly inside the Walmart interface. This integration might embody options like personalised spending limits based mostly on buying historical past and real-time notifications about upcoming funds.

- Expanded Product Classes: At present, Klarna may not be obtainable for all product classes inside Walmart. Future iterations might see Klarna being prolonged to embody a wider vary of things, from groceries and electronics to dwelling items and even companies provided by Walmart, similar to tire modifications or imaginative and prescient care. This enlargement would supply shoppers with higher flexibility in managing their purchases.

- Superior Personalization: Klarna might leverage information analytics to supply extremely personalised fee plans. This might contain tailoring installment schedules and rates of interest based mostly on particular person buyer profiles, buying habits, and creditworthiness. The purpose is to supply a extra personalized and accessible financing expertise.

- Integration with Walmart+ Advantages: Think about a state of affairs the place Walmart+ members obtain unique Klarna advantages, similar to prolonged fee phrases or decrease rates of interest. This integration might incentivize Walmart+ subscriptions and improve the general worth proposition for loyal clients.

- Augmented Actuality (AR) Procuring: Think about the potential of AR integration. Prospects might use their smartphones to visualise how Klarna funds would have an effect on their month-to-month price range whereas looking merchandise in-store. This interactive component might enhance decision-making and increase buyer confidence.

Evolving Over Time

The partnership between Klarna and Walmart is more likely to evolve by way of a number of phases, adapting to market traits and client suggestions.

- Section 1: Consolidation and Optimization: The preliminary focus shall be on solidifying the prevailing infrastructure. This part will contain refining the in-store fee course of, bettering customer support, and optimizing the combination for effectivity.

- Section 2: Growth of Options and Companies: This stage will introduce new options and companies, similar to enhanced integration with the Walmart app, personalised fee plans, and expanded product classes eligible for Klarna financing.

- Section 3: Ecosystem Integration and Strategic Partnerships: The ultimate part will contain a deeper integration inside Walmart’s ecosystem, doubtlessly together with partnerships with different monetary establishments or expertise suppliers to boost the general buyer expertise. This might contain introducing options like rewards applications or loyalty advantages particularly tied to Klarna utilization.

The evolution of Klarna at Walmart shall be a dynamic course of, pushed by technological innovation and a deep understanding of client wants.

Safety and Privateness: Klarna at Walmart

Navigating the world of in-store funds can generally really feel like a high-wire act. You need the comfort of recent fee strategies, however you additionally need to hold your monetary data locked down tight. This part delves into how Klarna and Walmart work collectively to supply a safe and personal expertise if you use Klarna on the checkout. We’ll discover the measures taken to guard your information and tackle potential considerations.

Knowledge Safety Measures

Klarna and Walmart prioritize the safety of your information throughout in-store transactions. They make use of a multi-layered strategy to safeguard your data, utilizing a mix of applied sciences and practices.The safety measures applied embody:

- Encryption: Each Klarna and Walmart make the most of sturdy encryption protocols, similar to Transport Layer Safety (TLS), to encrypt delicate information throughout transmission. This implies your private and monetary data is scrambled into an unreadable format because it travels between your gadget, the Walmart point-of-sale system, and Klarna’s servers.

- Tokenization: As an alternative of storing your precise bank card particulars, Klarna makes use of tokenization. A novel, randomly generated “token” is created to characterize your card data. This token is used for transactions, making it just about inconceivable for hackers to steal your precise card quantity, even when they have been to intercept the information.

- Fraud Detection Methods: Klarna employs subtle fraud detection programs that analyze transactions in real-time. These programs search for suspicious exercise, similar to uncommon spending patterns or transactions from high-risk places. If a transaction is flagged as doubtlessly fraudulent, it may be blocked or require extra verification.

- Compliance with Trade Requirements: Each firms adhere to strict business requirements, such because the Fee Card Trade Knowledge Safety Normal (PCI DSS). PCI DSS compliance requires rigorous safety measures to guard cardholder information, together with common safety audits, vulnerability scans, and penetration testing.

- Two-Issue Authentication (2FA): Klarna might make the most of two-factor authentication for added safety. Which means along with your password, you may be required to supply a second type of verification, similar to a code despatched to your telephone, to verify your id.

Privateness Practices

Klarna and Walmart are dedicated to defending your privateness. They’ve insurance policies in place to manipulate how your information is collected, used, and shared.Key privateness practices embody:

- Knowledge Minimization: Each Klarna and Walmart solely acquire the information essential to course of your transactions and supply their companies. They keep away from amassing pointless data.

- Privateness Insurance policies: Klarna and Walmart have complete privateness insurance policies that designate how they acquire, use, and share your information. These insurance policies are simply accessible on their web sites and inside their apps. It is best to evaluate these insurance policies to grasp how your data is dealt with.

- Restricted Knowledge Sharing: Klarna and Walmart sometimes share your information solely with mandatory events, similar to fee processors and monetary establishments, to facilitate transactions. They don’t promote your information to 3rd events for advertising functions.

- Person Management: You could have management over your information. You may sometimes view, replace, and delete your data by way of your Klarna account. It’s also possible to opt-out of sure advertising communications.

- Compliance with Privateness Rules: Klarna and Walmart adjust to related privateness laws, such because the Basic Knowledge Safety Regulation (GDPR) and the California Client Privateness Act (CCPA), the place relevant.

Addressing Potential Safety Issues

Whereas Klarna and Walmart take intensive measures to safe your information, it is at all times smart to concentrate on potential safety dangers and take steps to guard your self.Potential safety considerations and find out how to mitigate them:

- Phishing Assaults: Be cautious of phishing emails or texts that seem like from Klarna or Walmart. These assaults attempt to trick you into offering your private data. At all times confirm the sender’s electronic mail tackle and web site URL earlier than clicking on any hyperlinks or offering any information.

- Malware: Guarantee your units are protected with up-to-date antivirus software program and firewalls. This helps forestall malware from stealing your information.

- Public Wi-Fi: Keep away from making monetary transactions over unsecured public Wi-Fi networks. These networks will be susceptible to eavesdropping. Use a safe, personal community or your cell information as a substitute.

- Account Safety: Create robust, distinctive passwords on your Klarna and Walmart accounts. Allow two-factor authentication every time attainable.

- Transaction Monitoring: Frequently evaluate your Klarna transaction historical past and your financial institution statements for any unauthorized exercise. Report any suspicious transactions instantly.

- Bodily Safety: Be conscious of your environment when coming into your PIN on the checkout. Defend the keypad from view to stop shoulder browsing.